Financial Briefs

Email This Article To A Friend

A 2023 Tax Break For Small Business Owners

With a recession more likely following the banking crisis in March, small business owners and those starting new businesses receive some relief from this new tax break that became effective in 2023.

The labor market remains strong, and the number of individuals looking for jobs still outnumber job openings, according to the latest government data. However, the pace of job creation is expected to slow, and layoffs are expected to increase through the end of 2023.

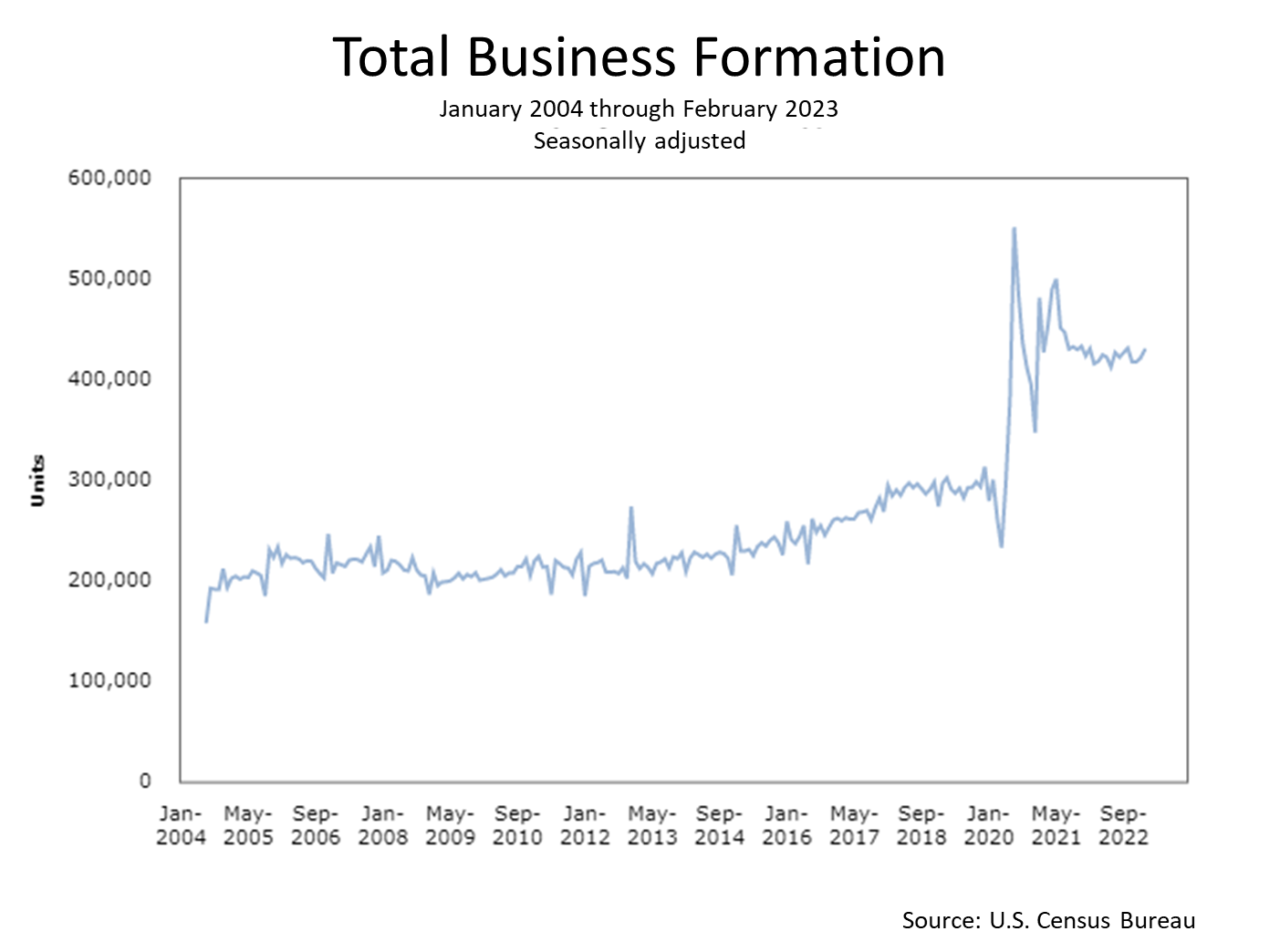

Labor market turmoil that followed the pandemic motivated more individuals to start businesses and enter the “gig economy,” and that trend could be repeated in the months ahead. A big benefit of starting a business is that you can establish your own 401(k) retirement plan, which enables tax-advantaged investment benefits. In addition to providing new business owners a way to save for retirement, a 401(k) provides a way of retaining and attracting employees.

In 2023, small businesses are eligible for a credit on 100% of the cost of starting a qualified retirement plan, up from a 2022 credit of up to 50%. The increased credit does not apply to defined benefit plans.

Setting up an employer plan makes your company a fiduciary, which involves risk and responsibilities that must be considered. Unless you know a lot about retirement plans or are committed to spending hours researching the tax, legal and fiduciary issues involved, finding a low-expense plan provider with a broad array of investment choices may require professional guidance.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.